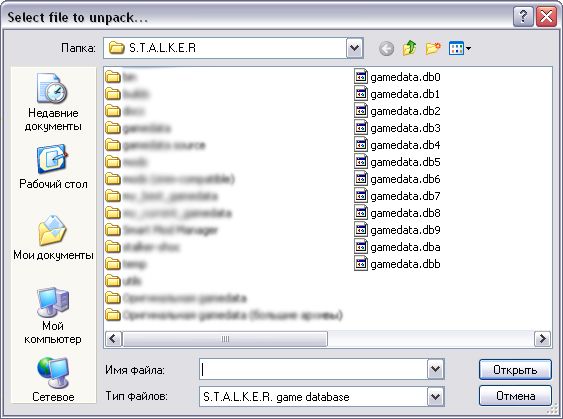

Programmu Stalkerdataunpackerru

Welcome to Bitsummit's channel on Twitch. Watch them stream Talk Shows and other content live and join the community! Welcome to Bitsummit's channel on Twitch. Watch them stream Talk Shows and other content live and join the community!

This article may lend to certain ideas, incidents, or controversies. Please by rewriting it in a that contextualizes different points of view. ( February 2013) () () Structural adjustment programmes ( SAPs) consist of loans provided by the (IMF) and the (WB) to countries that experienced economic crises.

The two Institutions require borrowing countries to implement certain policies in order to obtain new loans (or to lower interest rates on existing ones). The conditionality clauses attached to the loans have been criticized because of their effects on the social sector. SAPs are created with the goal of reducing the borrowing country's in the short and medium term or in order to adjust the economy to long-term growth. The bank from which a borrowing country receives its loan depends upon the type of necessity. The IMF usually implements stabilization policies and the WB is in charge of adjustment measures.

SAPs are supposed to allow the economies of the developing countries to become more market oriented. This then forces them to concentrate more on trade and production so it can boost their economy. Through conditions, SAPs generally implement 'free market' programmes and policy. These programs include internal changes (notably and ) as well as external ones, especially the reduction of. Countries that fail to enact these programmes may be subject to severe fiscal discipline.

Critics argue that the financial threats to poor countries amount to blackmail, and that poor nations have no choice but to comply. [ ] Since the late 1990s, some proponents of structural adjustments (also called structural reform), such as the World Bank, have spoken of ' as a goal. SAPs were often criticized for implementing generic free-market policy and for their lack of involvement from the borrowing country. To increase the borrowing country's involvement, developing countries are now encouraged to draw up (PRSPs), which essentially take the place of SAPs. Some believe that the increase of the local government's participation in creating the policy will lead to greater ownership of the loan programs and thus better fiscal policy.

The content of PRSPs has turned out to be similar to the original content of bank-authored SAPs. Critics argue that the similarities show that the banks and the countries that fund them are still overly involved in the policy-making process. [ ] Within the IMF, the was succeeded by the, which is in turn succeeded by the. As of 2018, has been the largest recipient of structural adjustment program loans since 1990.

Such loans cannot be spent on health, development or education programs. The largest of these have been to the banking sector ($2 trillion for IBRD 77880) and for ($1.5 trillion for IBRD 85590). Chertezhi formi dlya zhb koljca. See also: A common policy required in structural adjustment is the privatization of state-owned industries and resources. This policy aims to increase efficiency and investment and to decrease state spending.

State-owned resources are to be sold whether they generate a fiscal profit or not. Critics have condemned these privatization requirements, arguing that when resources are transferred to foreign corporations and/or national elites, the goal of public prosperity is replaced with the goal of private accumulation. Furthermore, state-owned firms may show fiscal losses because they fulfill a wider social role, such as providing low-cost utilities and jobs. Some scholars [ ] have argued that SAPs and neoliberal policies have negatively affected many developing countries. Austerity [ ] Critics hold SAPs responsible for much of the economic stagnation that has occurred in the borrowing countries.